form b income tax malaysia

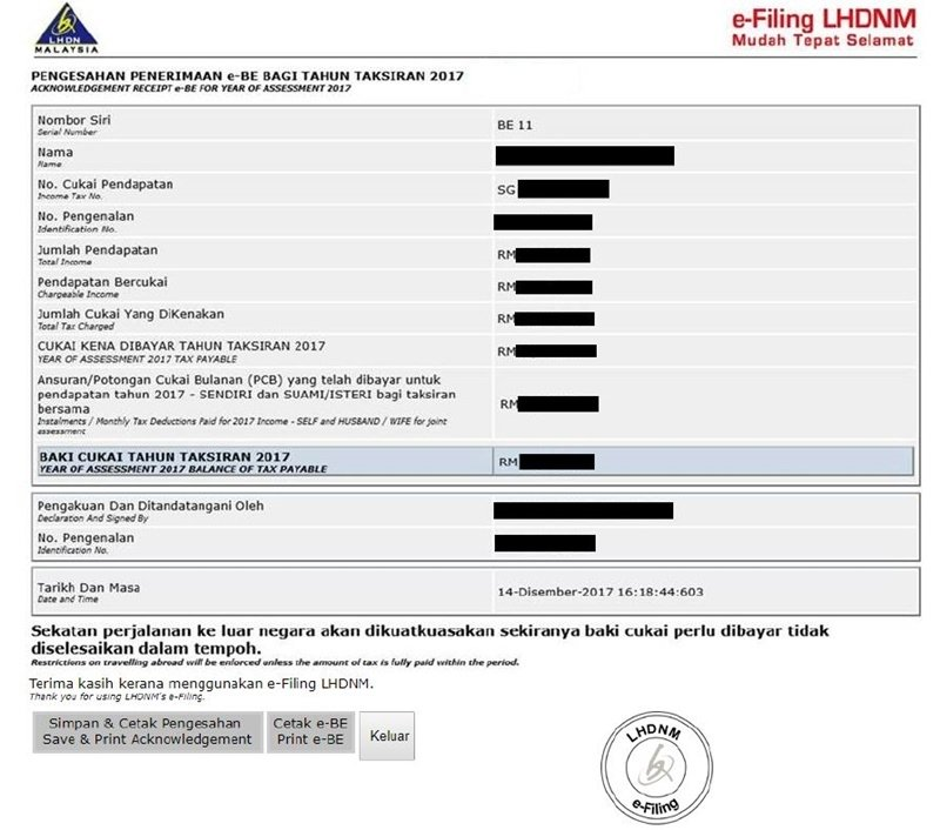

In Malaysia the process for filing your income tax returns depends on the type of income you earn and subsequently what type of form you should be filing. 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income.

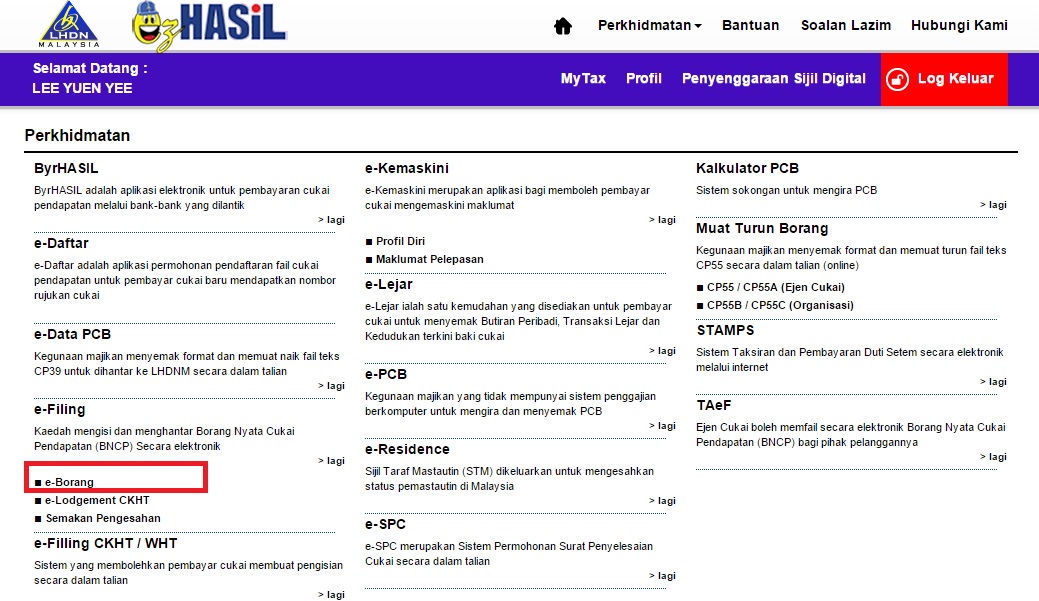

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Assessed in the name of the spouse both are still reguired to fill out separate tax forms BBEThe husband or wife whose income is to be assessed in the name of the spouse does.

. On the First 5000. FREQUENTLY ASKED QUESTIONS - FORM B PART 1. 1 Due date to furnish this form and pay tax or balance of tax payable.

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or. Postcode City State IMPORTANT REMINDER Due date to furnish this form and pay tax or balance of tax payable. Assessment Of Real Property Gain Tax.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. Correspondence address State 2 a 8 FORM B 2019 RESIDENT INDIVIDUAL WHO CARRIES ON BUSINESS Date received 1 Date received 2 FOR OFFICE USE IMPORTANT. Income Tax Return Form ITRF Every individual in Malaysia including resident or non-resident who is liable to tax is required to declare his income to Inland Revenue Board of.

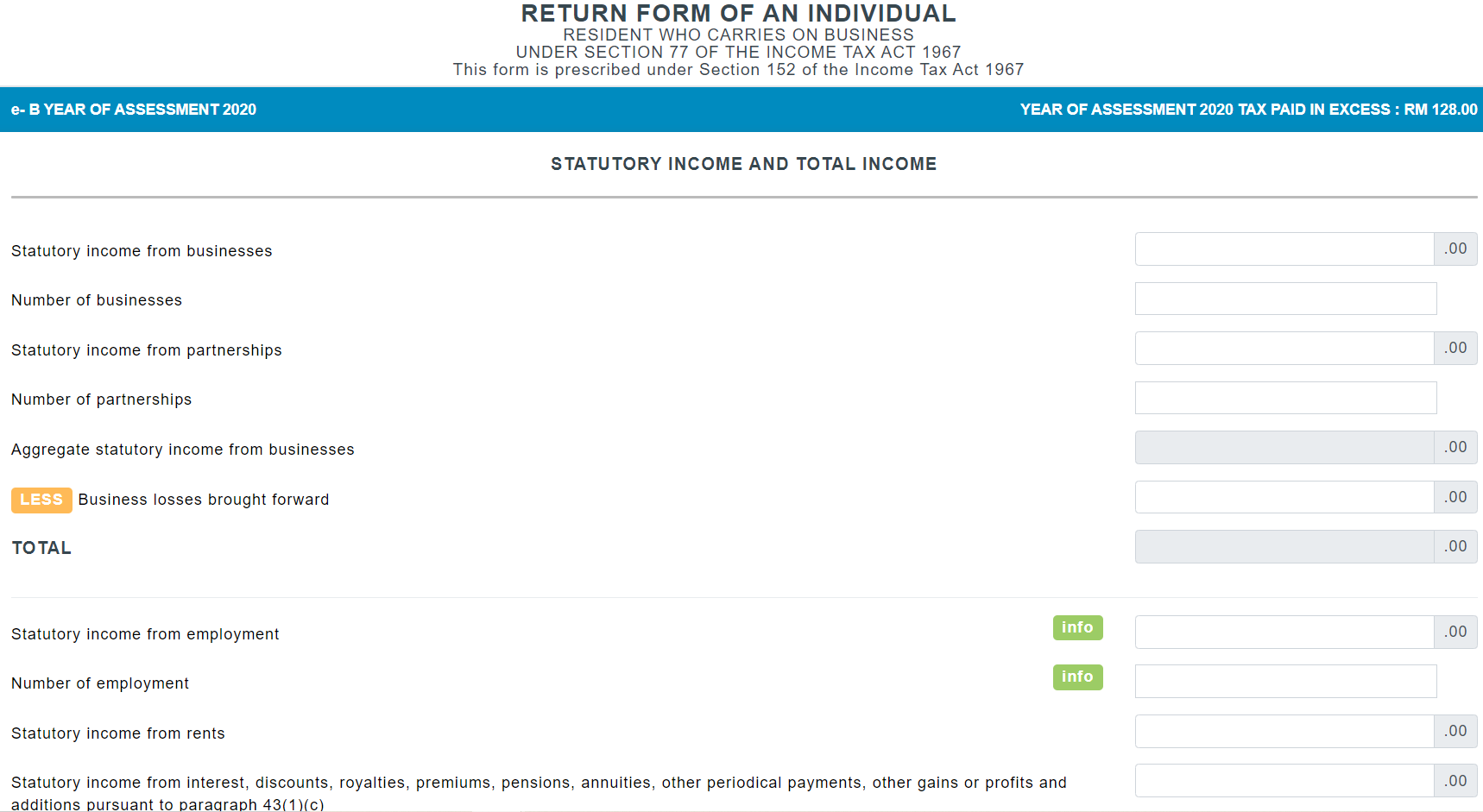

1 An individual who carries on a business is required to fill out the Form B. For individuals with business income income other than employment income you will need to file the Form B. Imposition Of Penalties And Increases Of Tax.

On the First 5000 Next 15000. The Freelancers Guide To Filing Taxes In Malaysia. Calculations RM Rate TaxRM A.

FORM CP204 CP204A. What is Form B Form B is the income tax. Form B needs to be furnished by an individual who is resident in Malaysia and carries on a.

Form BE income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business. Forms BE BT M MT TF TP and TJ for YA 2021 for taxpayers not carrying on a business. Imposition Of Penalties And Increases Of Tax.

Pegangan Dan Remitan Wang Oleh Pemeroleh. 2 Married individuals who elect for separate assessment are required to fill out separate tax forms. Foreigners who qualify as tax-residents follow the same tax.

Cancellation Of Disposal Sales Transaction. FORM CP22A CP22B6. Cancellation Of Disposal Sales Transaction.

On the First 20000. Who needs to furnish Form B. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

Assessed in the name of the spouse both are still reguired to fill out separate tax forms BBEThe husband or wife whose income is to be assessed in the name of the spouse does. Non-resident stays in Malaysia for less than 182 days and is employed for at least 60 days in a calendar year. 30 April 2022 2 Submission through e-Filing e-BE can be made via httpsmytaxhasilgovmy.

A qualified person defined who is a knowledge worker residing in. Paying income tax due. E-Filing is not available for Form TJ.

As of 2018 it is stated that you must pay taxes if your annual income exceeds RM34000 per year. 30 Jun 20 2 Submission through e. FAQs about Form B.

Assessment Of Real Property Gain Tax. It will be applied to your chargeable income which is obtained after deducting all your business losses allowable expenses approved donations and individual tax reliefs. Pegangan Dan Remitan Wang Oleh Pemeroleh.

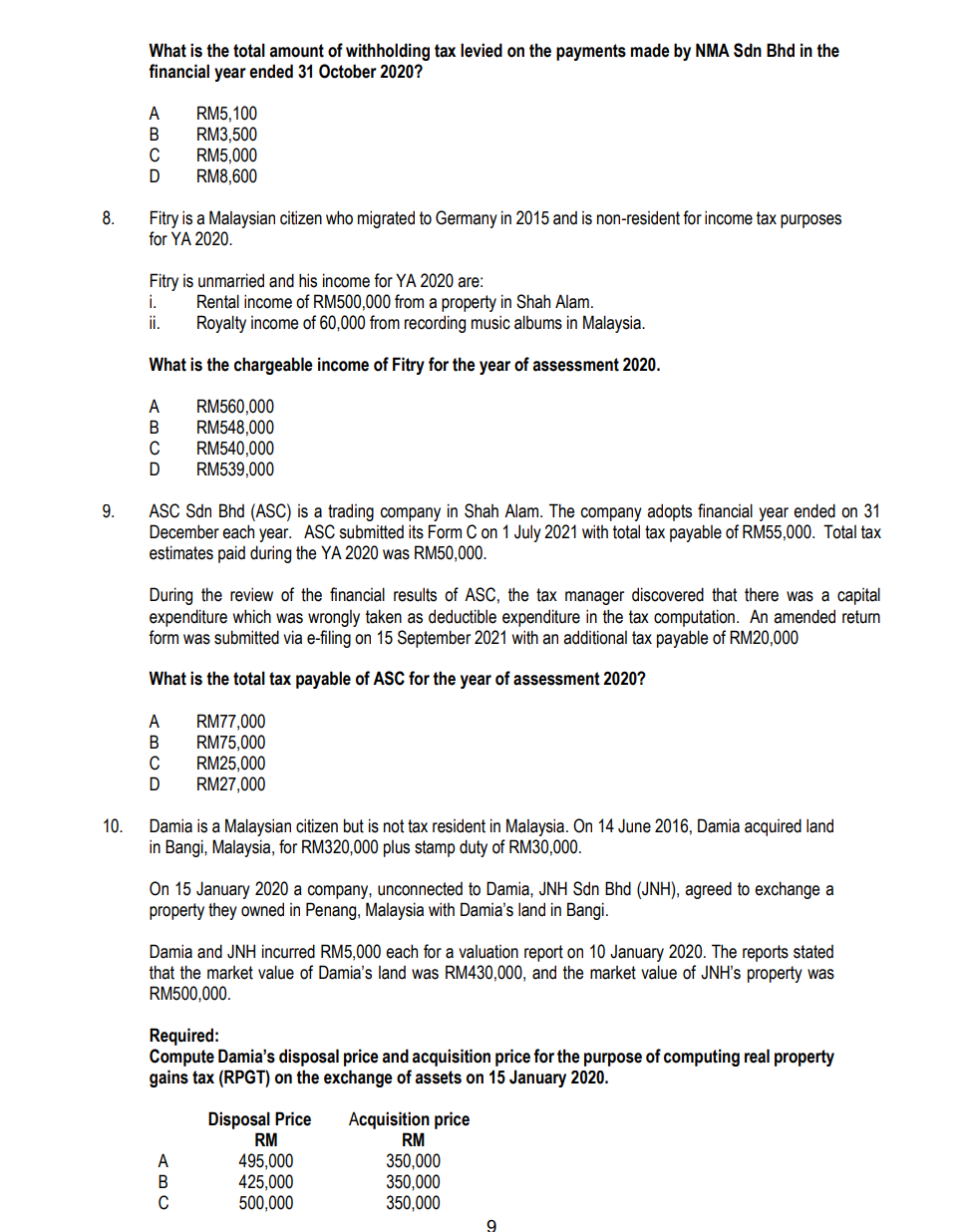

Section B All Six Questions Are Compulsory And Must Chegg Com

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Income Tax Formula Excel University

Lhdn Tax Filing Deadline Extended By 2 Months Rsm Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

A Malaysian S Last Minute Guide To Filing Your Taxes

The Irs Made Me File A Paper Return Then Lost It

The Complete Income Tax Guide 2022

The Complete Income Tax Guide 2022

Income Tax Everything They Should Have Taught Us In School The Full Frontal

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Tax Filing Deadline 2022 Malaysia

20190408 Form B P Business Tax For Sole Proprietor Partnership Session 1 Youtube

P M Co Chartered Accountant Form Ea Ec Year 2020 Pursuant To The Provisions Of Subsection 83 1a Of The Income Tax Act 1967 Ita 1967 Form Cp8a Form Ea

5 Tips For Sole Proprietors In Malaysia Lhdn Borang B Tax Filing Youtube

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Tis The Season To File Your Taxes Again So We Thought We D Help You Out With E Filing Rojakdaily

Comments

Post a Comment